What states have the best personal income tax

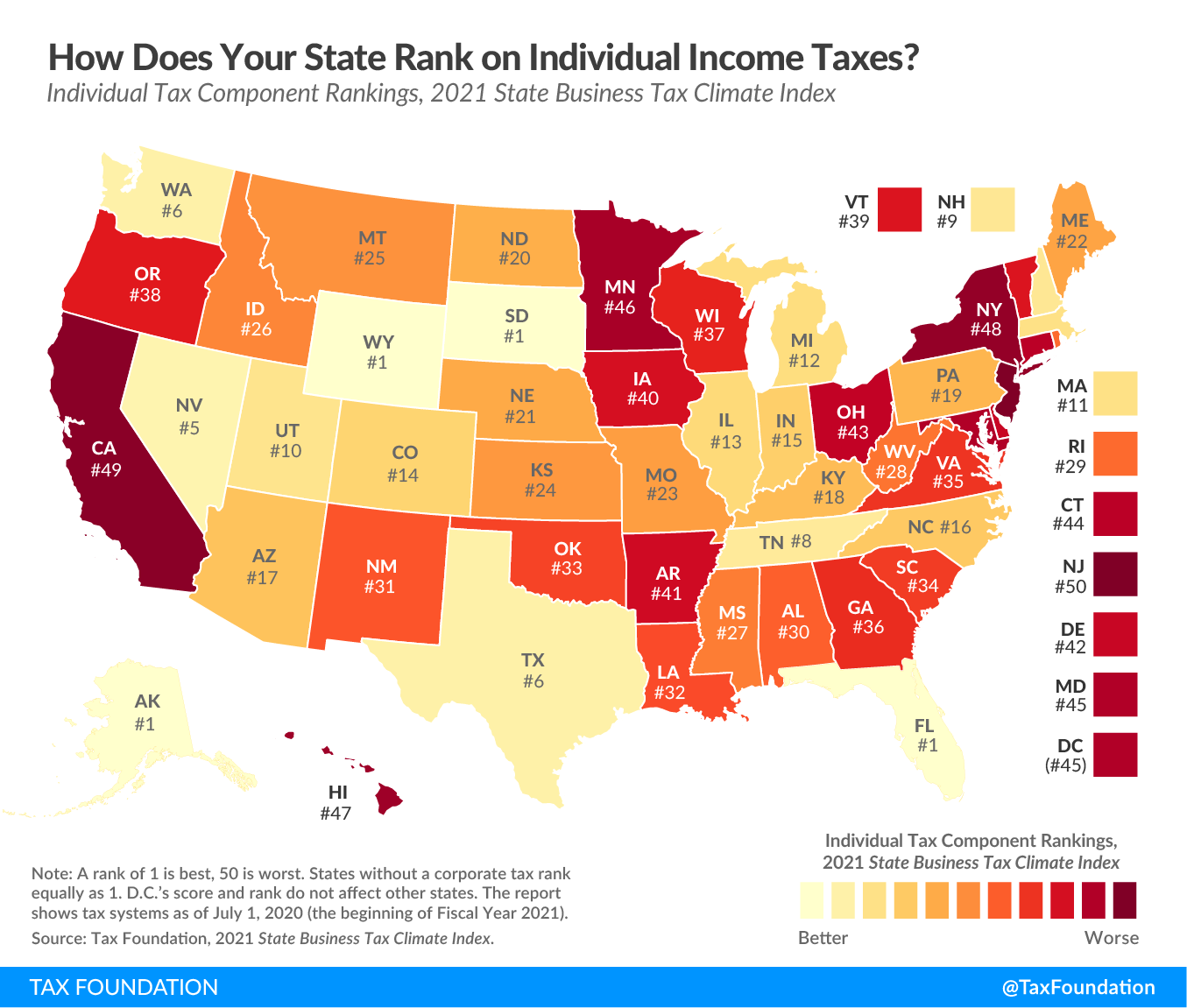

States with a perfect score on the individual income tax component (Alaska, Florida, South Dakota, and Wyoming) have no individual income tax and no payroll taxes besides the unemployment insurance tax. The next highest-scoring states are Nevada, Tennessee, Texas, Washington, and New Hampshire.

Which state pays the most in taxes

Total Federal Taxes Paid by State

| FEDERAL TAXES PAID BY STATE | ||

|---|---|---|

| RANK | STATE | FEDERAL TAXES PAID BY STATE (in thousands) |

| 1 | California | $234,499,671 |

| 2 | New York | $140,510,002 |

| 3 | Texas | $133,417,081 |

What are the best and worst states for taxes

The states with the highest sales tax burden are Hawaii (6.71%), Washington, (5.66%) and New Mexico (5.62%), while the states with the lowest sales tax burden are New Hampshire (1.07%), Delaware (1.09%) and Oregon (1.11%).

What is the average state income tax in the US

The average American pays about 8.9% of their annual income in state taxes.

Which state in US has lowest tax

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

What state has worst income tax

The top 10 highest income tax states (or legal jurisdictions) for 2021 are:California 13.3%Hawaii 11%New Jersey 10.75%Oregon 9.9%Minnesota 9.85%District of Columbia 8.95%New York 8.82%Vermont 8.75%

What are the top 3 most taxed states

Here are the top 10 states with highest taxes:New York – 15.9%Connecticut – 15.4%Hawaii – 14.1%Vermont – 13.6%California – 13.5%New Jersey – 13.2%Illinois – 12.9%Virginia – 12.5%

Which state has lowest income tax in USA

Alaska

The Tax in the USA burden in Alaska is around 5.10%. It has no state income or any other sales tax. The state or local tax burden on Alaskans mainly includes property income sales and excise taxes, which is just around 5.10% of your income. It is the lowest tax of all 50 states.

Which US state has lowest taxes

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

What are the 10 least tax friendly states

The 10 States With the Highest Tax Burden

| State | Tax as % of Income | |

|---|---|---|

| 1. | Illinois | 16.9% |

| 2. | Connecticut | 15.3% |

| 3. | New Jersey | 14.8% |

| 4. | New Hampshire | 14.3% |

What is the least tax friendly state

States with the highest tax burdens:Maine (11.14%)Vermont (10.28%)Connecticut (9.83%)New Jersey (9.76%)Maryland (9.44%)Minnesota (9.41%)Illinois (9.38%)Iowa (9.15%)

Where is the best place to live for taxes

1. Cheyenne, Wyoming. While not an obvious candidate, Cheyenne, Wyoming tops the list of U.S. cities with the lowest tax rates. Cheyenne tax rates are low across the board, with an average 9.7% rate for lower-income families.

What state has the worst taxes

New York has the highest state income tax burden out of any other state. In 2020, the state collected income taxes that amounted to 4.7% of per capita personal income, or nearly $3,500 per person.

What states are tax free in the US

As of 2023, eight states — Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming — do not levy a state income tax. A ninth state, New Hampshire, does not tax earned income, but it does impose a 4% tax on dividends and interest. This is set to expire in 2027.

Who pays more taxes California or Texas

WalletHub estimates Sales & Excise Taxes of $4591 for the theoretical median household in Texas versus only $3292 in California. But sales tax rates are generally lower in Texas than in California. According to the Sales Tax Handbook, combined state and local sales taxes in California range from 7.25% to 10.75%.

What are the 7 tax free states in us

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

What is the best state to live in financially

North Dakota

North Dakota takes the cake as the best state in the U.S. to save money in. With the third lowest debt-to-income ratio in the country for Q3 2022—and the second lowest percentage of income spent on housing costs and rent—North Dakotans are able to keep more money in their pockets.

What state has the worst tax rate

States with the highest tax burdensNew York (12.75%)Hawaii (12.70%)Maine (11.42%)Vermont (11.13%)Minnesota (10.20%)New Jersey (10.11%)Connecticut (10.06%)Rhode Island (9.91%)

What state has the lowest taxes to live in

10 states with the lowest personal income tax ratesWyoming.Washington.Texas.Tennessee.South Dakota.Nevada.Florida.Alaska.

What city pays the highest tax in the US

Bridgeport, Connecticut

1. Bridgeport, Connecticut. It's no real surprise that one of the wealthiest cities in the U.S. also imposes some of the highest taxes. In Bridgeport, as of 2022, approximately 20% of families that live here report income of $200,000 or more.

Is Texas or Florida better for taxes

Florida Total Tax Burden

Despite not having an individual income tax, Texas' total tax burden is much higher (8.22%) than Florida's.

Why doesn’t Texas pay income tax

The Texas Constitution forbids personal income taxes. Instead of collecting income taxes, Texas relies on high sales and use taxes. When paired with local taxes, total sales taxes in some jurisdictions are as high as 8.25%. Property tax rates in Texas are also high.

What state has the cheapest taxes

10 states with the lowest personal income tax ratesWyoming.Washington.Texas.Tennessee.South Dakota.Nevada.Florida.Alaska.

What is the number 1 cheapest state to live in

Mississippi

The cheapest states to live in are Mississippi, Oklahoma, Kansas, Alabama, Georgia, Missouri, Iowa, Indiana, West Virginia, and Tennessee. Mississippi is the cheapest state to live in in the US, with a cost of living index of 85. The second cheapest state to live in is Oklahoma, with a cost of living index of 85.8.

What state is the cheapest to make a living

13 States With the Lowest Cost of Living13 Cheapest States to Live in for 2023. Here they are, folks:Mississippi. Mississippi is the cheapest place to live in the United States, with a cost of living 15.6% lower than the national average.Oklahoma. Let's head west!Kansas.Alabama.Georgia.Ohio.Iowa.