Who pays most taxes in the US

The highest-earning Americans pay the most in combined federal, state and local taxes, the Tax Foundation noted. As a group, the top quintile — those earning $130,001 or more annually — paid $3.23 trillion in taxes, compared with $142 billion for the bottom quintile, or those earning less than $25,000.

What race pays the most taxes

Projected Profile of Taxpayers by Race & Ethnicity

| Characteristic | Annual Social Security taxes paid (2022 $) at the— | |

|---|---|---|

| 10th percentile | 90th percentile | |

| White, non-Hispanic | $970 | $17,434 |

| Black or African American, non-Hispanic | $613 | $14,050 |

| All other races, non-Hispanic | $1,052 | $18,488 |

What percentage of the US population pays the most taxes

The top 1 percent of taxpayers (AGI of $548,336 and above) paid the highest average income tax rate of 25.99 percent—more than eight times the rate faced by the bottom half of taxpayers.

What was the highest US tax rate in history

94%

The top income tax rate reached above 90% from 1944 through 1963, peaking in 1944 when top taxpayers paid an income tax rate of 94% on their taxable income. Starting in 1964, a period of income tax rate decline began, ending in 1987.

Who pays the lowest taxes in the US

So let's ask this group a simple question what percentage of your income gets taxed. Most Americans pay multiple income taxes to the federal government. And state governments and local governments.

Who has the lowest taxes in the USA

In 2020, the average American contributed 8.9% percent of their income in state taxes. Alaska had the lowest average overall tax burden – measured as total individual taxes paid divided by total personal income – at 5.4%, followed by Tennessee (6.3%), New Hampshire (6.4%), Wyoming (6.6%) and Florida (6.7%).

Who pays the least taxes in the world

Summary of zero income tax countries

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

How much does the average American pay in taxes annually

The average federal income tax payment in 2020 was $16,615, according to the most recent data available from the IRS. However, that figure is an average, and is more than what most Americans actually pay each year.

What are the 5 most common taxes Americans pay

In fact, when every tax is tallied – federal, state and local income tax (corporate and individual); property tax; Social Security tax; sales tax; excise tax; and others – Americans spend 29.2 percent of our income in taxes each year.

What are the highest taxes in the world

Côte d'Ivoire citizens pay the highest income taxes in the world according to a survey by World Population Review. Côte d'Ivoire citizens pay the highest income taxes in the world according to this year's survey findings by World Population Review.

What was the lowest tax rate in the US

Alaska had the lowest average overall tax burden – measured as total individual taxes paid divided by total personal income – at 5.4%, followed by Tennessee (6.3%), New Hampshire (6.4%), Wyoming (6.6%) and Florida (6.7%).

Do Texans pay more taxes than Californians

Though Texas has no state-level personal income tax, it does levy relatively high consumption and property taxes on residents to make up the difference. Ultimately, it has a higher effective state and local tax rate for a median U.S. household at 12.73% than California's 8.97%, according to a new report from WalletHub.

Which US has no income tax

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Do Texans pay more taxes than California

Though Texas has no state-level personal income tax, it does levy relatively high consumption and property taxes on residents to make up the difference. Ultimately, it has a higher effective state and local tax rate for a median U.S. household at 12.73% than California's 8.97%, according to a new report from WalletHub.

Which billionaire pays the least taxes

In some years, billionaires such as Jeff Bezos, Elon Musk and George Soros paid no federal income taxes at all. Billionaires avoid these taxes by taking out special ultra-low-interest loans available only to them and using their assets as collateral.

Which country is best to not pay taxes

Bermuda, the Cayman Islands, St Kitts and Nevis, Vanuatu, the UAE, and Antigua and Barbuda are some of the best tax-free countries in the world.

How much do the 1% of America pay in taxes

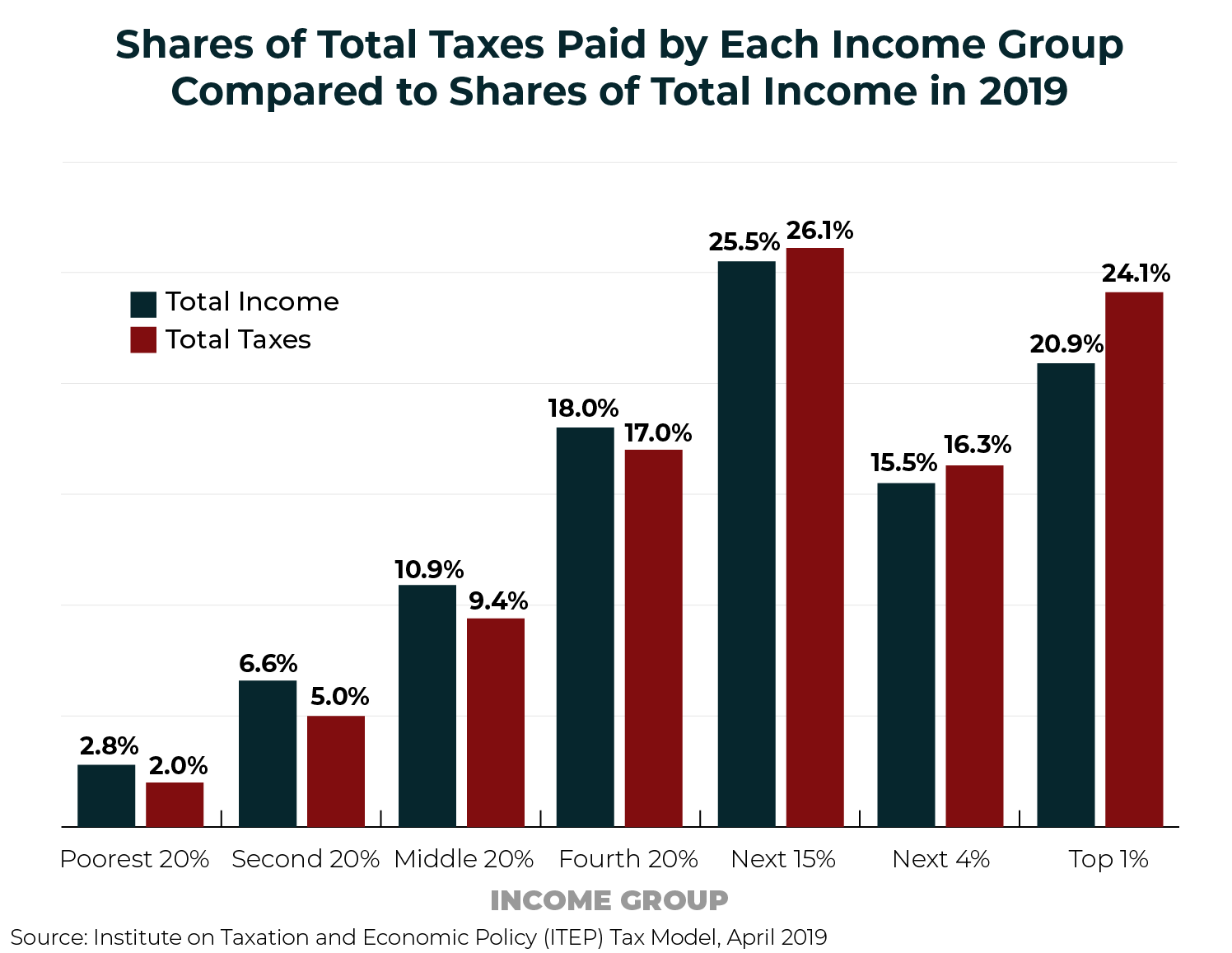

Because the top 1 percent paid 42.3 percent of the total federal income tax in 2020 while receiving 22.2 percent of total adjusted gross income, the logic goes, they're getting “soaked.”

Who pays more tax UK or USA

In absolute terms, you pay less income tax in the US. The highest rate of income tax in the US is 37% if you earn over $523k. In the UK, it's 45% if you earn over £150k. In many US states, you also have to pay state taxes – some states pay nothing, but New York, for example, the state taxes can be an additional 8.8%.

Who has the lowest taxes in the US

Lowest tax burdensAlaska – 5.06%Delaware – 6.12%New Hampshire – 6.14%Tennessee – 6.22%Florida – 6.33%Wyoming – 6.42%South Dakota – 6.69%Montana – 6.93%

What country has the lowest tax

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

Who pays most tax in Europe

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) had the highest top statutory personal income tax rates in Europe among OECD countries in 2022. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) had the lowest top statutory personal income top rates in Europe.

Who has higher taxes California or Texas

WalletHub estimates Sales & Excise Taxes of $4591 for the theoretical median household in Texas versus only $3292 in California. But sales tax rates are generally lower in Texas than in California. According to the Sales Tax Handbook, combined state and local sales taxes in California range from 7.25% to 10.75%.

Why do Texans not pay taxes

The Texas Constitution forbids personal income taxes. Instead of collecting income taxes, Texas relies on high sales and use taxes. When paired with local taxes, total sales taxes in some jurisdictions are as high as 8.25%.

What country has lowest taxes

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

Which state is richer Texas or California

Overall, in the calendar year 2022, the United States' Nominal GDP at Current Prices totaled at $25.463 trillion, as compared to $23.315 trillion in 2021. The three U.S. states with the highest GDPs were California ($3.6 trillion), Texas ($2.356 trillion), and New York ($2.053 trillion).