What is the purpose of accounts in business

The purpose of accounting is to accumulate and report on financial information about the performance, financial position, and cash flows of a business. This information is then used to reach decisions about how to manage the business, or invest in it, or lend money to it.

What is the benefits of having a business account

Benefits of a business bank accountFinancial protection for yourself and your business. Keeping personal finances separate from business finances by establishing a business bank account helps safeguard business and personal funds.Easier, more organized handling of expenses.Fewer tax-time headaches.Professionalism.

Why is a business account better than a personal account

Keeping personal assets separate from business assets can offer an advantage if your business is sued or you default on a debt. According to the Small Business Administration, business checking accounts can offer limited liability protection to business owners.

Is it necessary to have a business account

If you run a limited company, a separate business bank account is not a legal requirement, but it is recommended. As a limited company is a separate legal entity, the money belongs to the business rather than you and it needs to be kept separate.

Why can’t you use a personal account for business

Although having two bank accounts appears inconvenient, you shouldn't use a personal account for your business finances primarily because it can affect your legal liability. In fact, one of the first steps to owning a business should be opening a business bank account, in addition to a personal bank account.

Can I use a personal account for business

Legally, you can use your personal bank account for both business and non-business transactions, or you can set up a second personal bank account to use for your business. As a limited company is a separate legal entity, it needs to have its own business bank account.

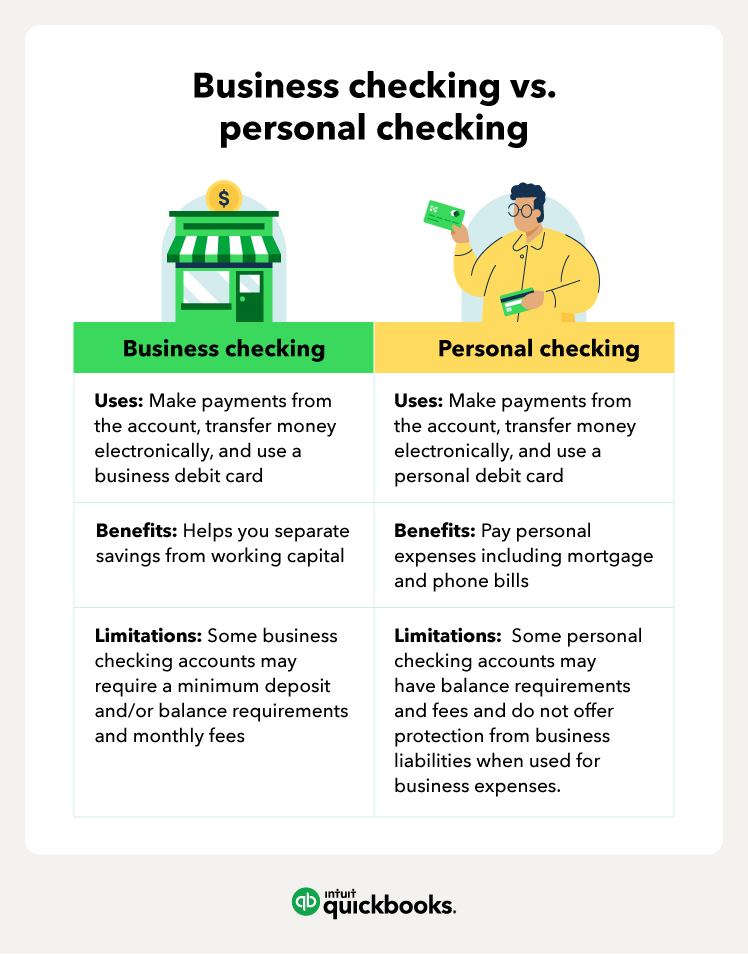

What is the difference between personal and business account

The main difference between business and personal bank accounts, as the name suggests, is that business bank accounts are used to manage business transactions while personal bank accounts are for personal expenses.

Is business account better than personal

Protecting Assets

According to the Small Business Administration, business checking accounts can offer limited liability protection to business owners. Additionally, enrolling in merchant services can offer purchase protections to your customers and keep their personal information secure.

Should I have a personal or business account

Some of the main differences include: Business bank accounts have more legal protections than personal bank accounts, meaning you won't be offered protection from business liabilities when using a personal checking account for business expenses. Business bank accounts can do a better job at solidifying your brand.

Is there an advantage to having a business account

Image is important in business, and having a separate business bank account can help to create a more professional image when dealing with suppliers and clients. It could help to build up your credibility and make you appear more trustworthy to clients, who may feel reluctant to send payments to a personal account.

Why would you want a business account instead of just a personal account

Having a separate business account makes it easier to manage your business. You can collect receipts in the account, as well as write checks for expenses. That will be much easier to manage than if you're attempting to do it all through a personal account.