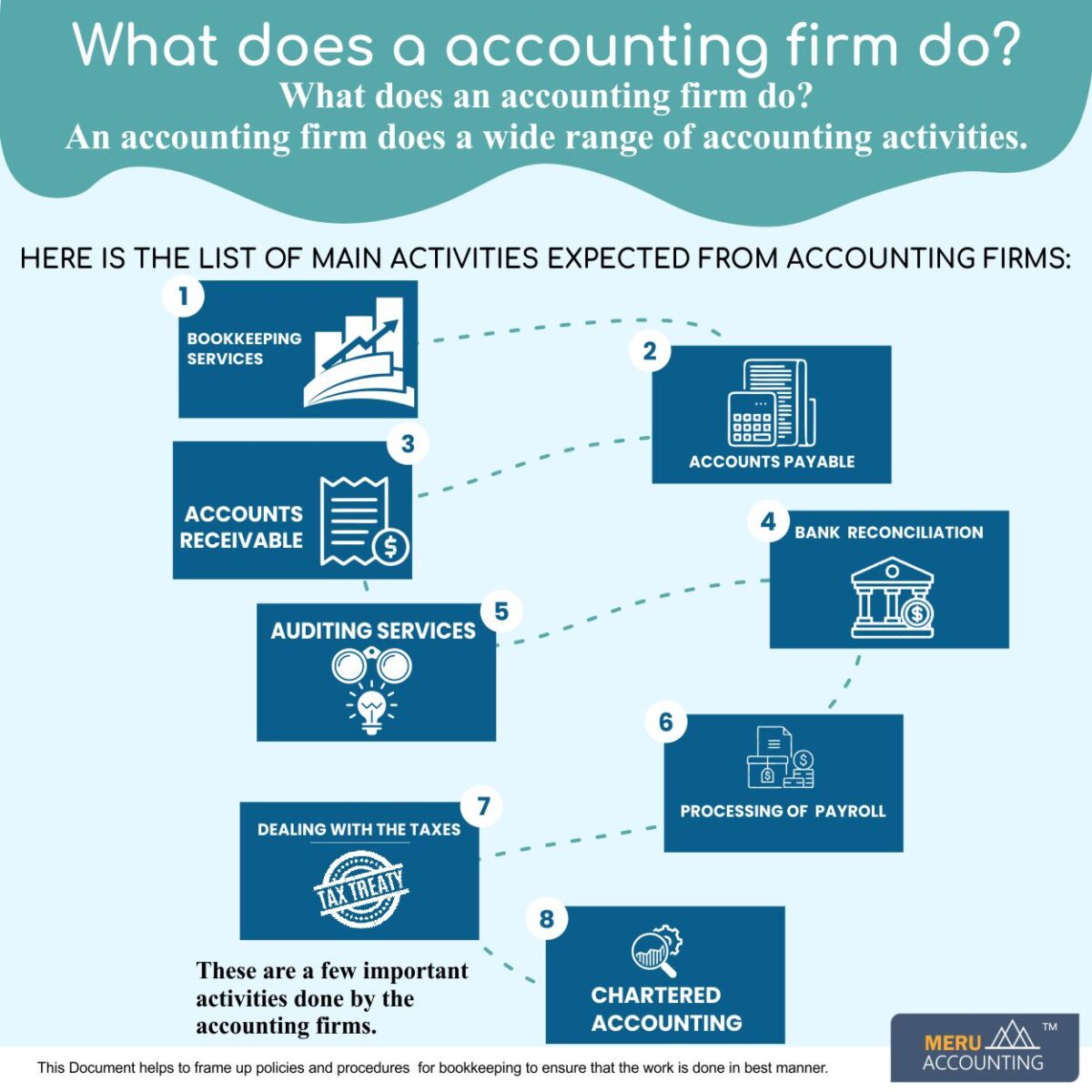

What is the work of accounting firm

An accounting firm is a group of accounting professionals that provides clients with financial management services. These services could include auditing, tax preparation and planning, payroll processing, bookkeeping, and advisory services.

What is the difference between an accountant and an accounting firm

Accounting firms are specialized service providers run by experienced accountants who serve either business customers or consumers. Like individuals, accounting firms can choose to specialize in different areas of accounting, such as business startups or liquidations.

What is an accounting firm example

A great example of full-service accounting firms are the Big Four accounting firms: Deloitte, PriceWaterhouseCoopers, Ernst & Young, and KPMG.

Is an accounting firm a good business

Running an accounting business requires a different set of skills and experience than working as an employee. As with any small business, establishing an accounting practice entails a great deal of work, but as Thomson Reuters notes, accounting firms are currently among the most profitable of all small businesses.

What do the Big 4 accounting firms do

What is the Big 4 The Big 4 are the four largest international accounting and professional services firms. They are Deloitte, EY, KPMG and PwC. Each provides audit, tax, consulting and financial advisory services to major corporations.

What does the CEO of an accounting firm do

CEOs are responsible for managing a company's overall operations. This may include delegating and directing agendas, driving profitability, managing company organizational structure, strategy, and communicating with the board.

Is a CPA better than an accountant

A CPA is better qualified than an accountant to perform some accounting duties, and recognized by the government as someone who is credible and an expert in the field. Individuals who have received a CPA designation are trained in generally accepted accounting principles and best practices (including online tools).

What is the difference between accounting firms and audit firms

Accountants are responsible for preparing financial documents, monitoring day-to-day bookkeeping for a firm's operations, and/or preparing and filing tax forms. Auditors verify the accuracy of financial statements and tax filings and may search for clues as to why some figures don't quite add up.

What is the difference between an accounting firm and an audit firm

Accountants are responsible for preparing financial documents, monitoring day-to-day bookkeeping for a firm's operations, and/or preparing and filing tax forms. Auditors verify the accuracy of financial statements and tax filings and may search for clues as to why some figures don't quite add up.

Who is the biggest Big 4 firm

Deloitte

The largest of the Big 4, Deloitte, earned $59.3 billion in revenue in 2022. It operates in more than 150 countries and employs 412,000 professionals.

What is the advantage of accounting firm

Save Money on Business Costs

You will know exactly where your money goes in terms of costs such as rents, insurance, interest rates, staff salaries etc. Targeting challenging areas will help liquidity and solvency of your business and give you a peace of mind at the same time.

Is it hard to make an accounting firm

Starting an accounting firm is like starting any small business – it requires a lot of work. However, industry and consulting firms list accounting firms as one of the single most profitable small businesses a person can start right now.

Is Big 4 accounting stressful

Many accountants experience burnout at some point in their careers because of the long hours and constant high pressure of working in a Big 4 firm. It starts with struggling to cope with workplace stress. Over time, they are left feeling exhausted, empty, and unable to function or cope with everyday life.

Which Big 4 is the most prestigious

PwC

A quick overview of the firms

PwC is the largest by revenue and the most prestigious of the Big Four with a strong and established audit client base. Deloitte is just a fraction smaller than PwC.

Is CEO higher than CFO

Differences. The CEO is the highest-ranking role in the organization. CEOs and CFOs are not equal in the organizational hierarchy, despite both having 'Chief' in their titles. Generally, the CEO reports to the board of directors, whereas the CFO reports to the CEO.

Can you become a CEO as an accountant

The ability to sell, show humility, learn different positions and departments, be relatable and trustworthy, and be patient are all key areas that enable long-term success for accountants wanting to reach that CEO position. They understand the numbers of the business.

Why CPA is better than ACCA

Key Differences ACCA vs CPA

CPA works for the Regulator of a business, whereas ACCA is the Advance module of Finance. The work experience required for ACCA is 1-2 years, whereas CPA requires 3 years. Both ACCA vs CPA degrees requires a minimum qualification of graduation.

Who is higher than an accountant

A controller, or comptroller, oversees the accounting operations of a firm, including managing staff. Because controllers' duties and responsibilities expand beyond that of an accountant, they typically command larger salaries.

Is Big 4 an accounting firm

What is the Big 4 The Big 4 are the four largest international accounting and professional services firms. They are Deloitte, EY, KPMG and PwC. Each provides audit, tax, consulting and financial advisory services to major corporations.

Why are there Big 4 accounting firms

The Big 4 gives instant credibility to any accounting professional at any level. Regardless of whether professionals leave to work in smaller firms or to head up corporate finance departments, the respect that comes with working with the Big 4 is unmatched.

What is the difference between consulting and accounting firms

A consultant is someone who provides professional or expert advice in a specific field. An accountant is a person who is in charge of an individual's or organization's financial records. Consultants and accountants both collaborate with clients to provide services that are critical to the client's business.

Do accounting firms perform audits

The primary role of an accountant is to handle a variety of tasks including tax preparation, financial planning and audits.

Who were the Big 8 firms

This book focuses on the firms that make up of the Big Eight – Arthur Andersen; Arthur Young; Coopers & Lybrand; Deloitte Haskins & Sells; Ernst & Whitney; Peat, Marwick, Mitchell; Price Waterhouse; and Touche Ross.

What are Big 5 firms

Big 5 Accounting Firm means any of the independent public accounting firms of Xxxxxx Xxxxxxxx, Deloitte & Touche, Ernst & Young, KPMG Peat Marwick, PriceWaterhouseCoopers, or their successors.

Why do you want to be an accounting firm

You Will Be In a Profession That Is Respected and Known for Integrity and Ethics. Accountants are respected business professionals, and accounting is known to be one of the most trustworthy professions. You will become a trusted advisor to others where you work, and your opinion will matter in making business decisions …